Spotlight on Southern European Hydro Power Generation

This summer's scorching temperatures and dry conditions have seen a steep decline in hydro generation in Europe.

September 2022

This summer’s scorching temperatures and dry conditions - which followed a winter of low precipitation - have seen a steep decline in hydro generation in the region, presenting a real challenge to power producers and policymakers alike.

September 2022

In our previous note, we looked at North West European gas balances for this winter and why it is crucial for European countries to cut back their gas demand to reduce the need for winter rationing of gas. In this note, we take a look at some of the reasons why it will be difficult to achieve gas demand reduction targets in the context of further disruptions in the power markets. This time our focus shifts to the Southern European power mix, which is taking the full brunt of an unprecedented drought.

This summer’s scorching temperatures and dry conditions – which followed a winter of low precipitation – have seen a steep decline in hydro generation in the region, presenting a real challenge to power producers and policymakers alike. Water reservoirs have been depleted to some of the lowest levels ever seen, exacerbating Europe’s multi-faceted energy crisis and driving power prices to record highs.

Hydro generation on downward trajectory

Since the beginning of 2021, hydro generation has been on a downward trajectory, falling from around an average of 20% of the power mix to below 10% by summer 2022. Hydro power output can be volatile even in normal times, but what sets the current crisis apart from the past is the scale and its reach. Not only this year’s water shortages had led to lower output both from pumped storage and run of the river generators, but the need to prioritize water for human consumption and irrigation brought about measures to limit hydro power generation in some areas in the months leading to summer.

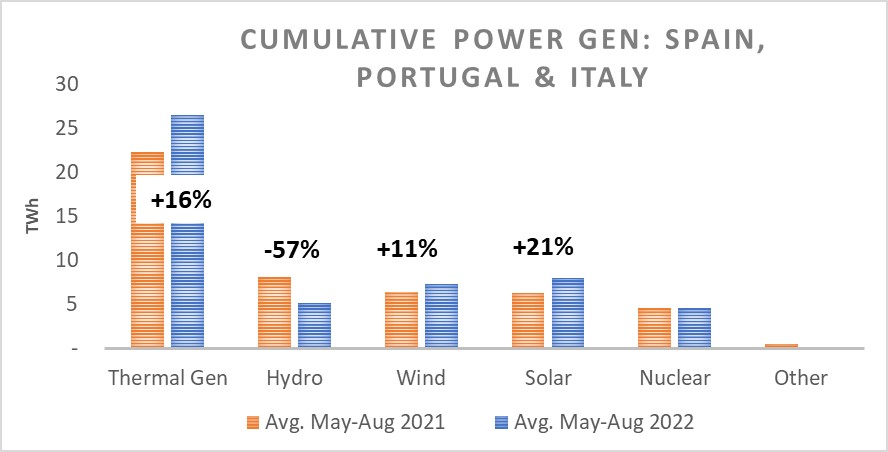

At the same time, high fuel prices in other sectors of the power industry have prompted some producers to optimize by keeping water reserves for winter production when fuel prices are expected to be much higher. As can be seen from the chart below hydro generation is estimated to have fallen by a whopping 57% between May and Aug 2022 compared to the same period last year. The loss of hydro generation has been partially offset by higher solar and wind performance. Solar output has seen the largest growth with cumulative generation for Spain, Italy and Portugal surpassing 8 TWh for the first time this summer. However, additional thermal generation in form of coal and gas burn were still needed to make up for the shortfall in hydro.

Source: Entso-E, Eurostat

In the face of gas shortages and record high prices, the need for higher gas burn has led to a steep decline in gas demand from industries and LDZ sectors – indicating that some form of re-prioritisation of demand may already be taking place in these markets which will carry on through the winter months.

Even with normal precipitation this winter, it will take some time for hydro stocks to get back to a more normal level, whilst a very cold winter (prolonged freezing temperatures) can exacerbate the crisis because of reduced hydraulic conductivity, slowing the flow of water into rivers and reservoirs, on top of the additional heating demand.

The new normal?

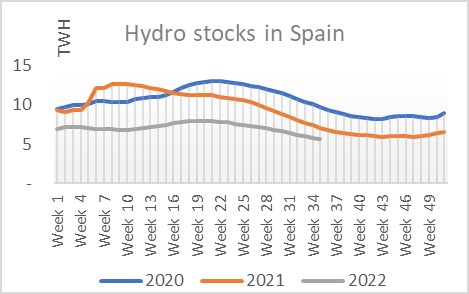

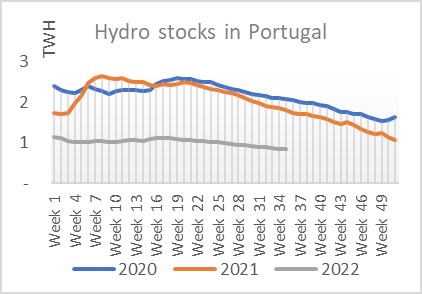

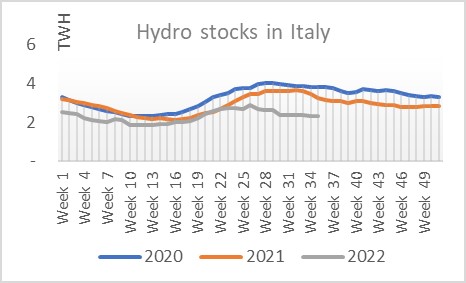

The charts below illustrate just how low water stock levels have reached in Spain, Portugal and Italy this year with far-reaching impact on human life. Far from a Southern European problem, the impact of water shortages had been acutely felt across Europe. In France, on top of reduced hydro generation, water shortages had reduced nuclear capacity, whilst some power producers Germany were unable to get delivery of coal due to low water levels in the Rhine. In northern Europe, Norway, where hydro generation accounts for the majority of its electricity production and exports, is contemplating a curb on its power exports due to low hydro reserves.

Source: Entso-E

Long term outlook for hydro generation

Notwithstanding the short-term disruptions, the industry expects a rethink of hydro generation in Europe in the long term. Lower levels at rivers and underground water reservoirs will become more common as European summers become hotter and glaciers shrink. Change could come from better management of water reserves (for example moving to seasonal generation), new technologies, or moving to other fuel types all together. This will present a significant challenge for Europe’s energy security as hydro power had long been one of the low-cost and reliable sources of renewable energy, balancing solar and wind generations. To achieve net zero targets, Europe has to replace the “lost” hydro generation with other renewable capacities over the next decade.

To ask any questions or discuss your requirements please contact us at info@mithras-analytics.com.